FPV drones have a significant impact on the battlefield. With this article, I aim to assess Ukraine’s FPV drone production dependency on Chinese components and whether substitutes are available. I spoke with several Ukrainian manufacturers, and found that the level of dependency on China remains high—particularly for motors, microelectronics, and cameras. Additionally, China holds a global monopoly on several critical metals and minerals, including neodymium, germanium, and carbon.

Ukrainian manufacturers are working hard to replace these imports wherever possible, but significant financial support is needed.

In a world where components from China might suddenly become unavailable, the Western alliance must start developing more efficient solutions. And the best time for this is right now.

Thank you for reading and supporting my work!

In April 2025, China suspended exports of a broad range of critical minerals and magnets, putting at risk the supply of key components for automakers, aerospace manufacturers, semiconductor companies, and military contractors worldwide. As of the end of June, China’s rare earth exports resumed, but not without restrictions. European suppliers are receiving enough licenses to avoid disruptions, yet many permits remain pending. Overall, China’s export controls have caused a 75% drop in rare earth magnet exports.

In May 2025, Zelensky stated that China stopped supplying Mavic drones to Ukraine and other European countries. Ukraine’s former Minister of Defence, Umerov, commented that Ukraine faced procurement challenges through various channels and across different countries. In response to that, “we launched a program to localize drones, which we achieved within a few months,” he said.

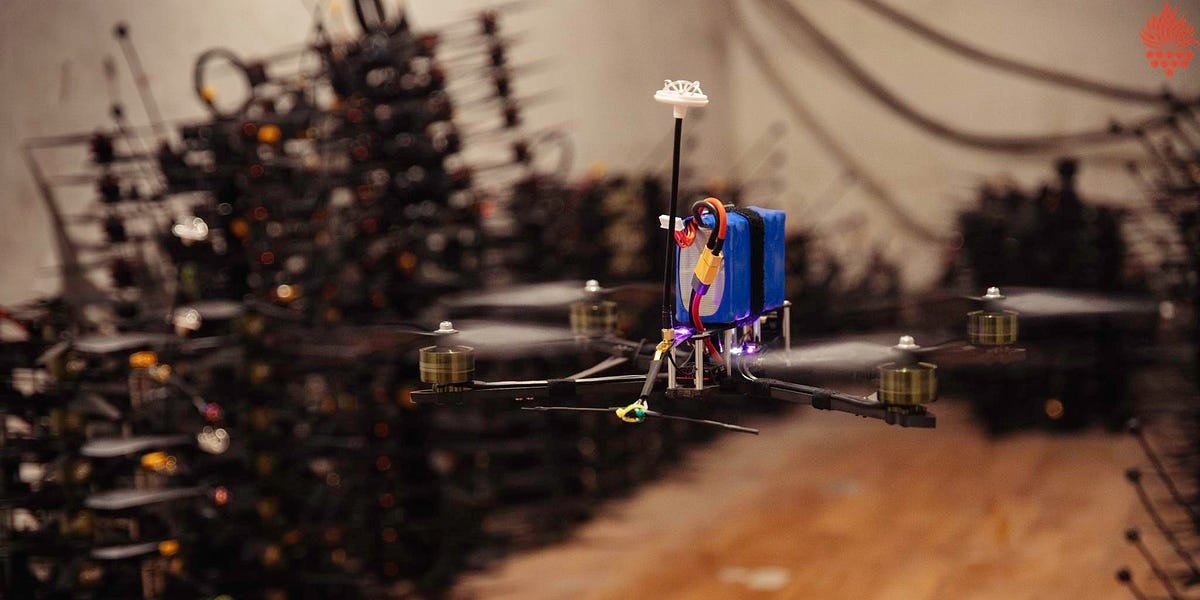

Ukraine is currently one of the largest producers of FPV drones in the world, and these drones have a significant impact on the battlefield, making their continued production essential.

Ukraine’s government identified localization of weapons production, equipment manufacturing, and repair as one of the priorities for 2024.

In March 2025, it was announced that Ukrainian UAV manufacturers who increase localized production share will gain advantages in public procurement. According to a new policy, drones with over 50% localization of components can secure guaranteed long-term government contracts of three, five, or ten years under the “Weapons of Victory” program.

However, full localization is considered challenging due to specialized components sourced internationally and the need for frequent drone design updates amid ongoing combat.

I spoke with four Ukrainian manufacturers to get their opinion on Ukraine’s dependency on Chinese components and the extent to which Ukraine needs to localize the production of certain parts. I would like to thank the investment fund MITS Capital for helping me establish these contacts (earlier, I wrote a large article about MITS). I also appreciate the support of the Brave Inventors national platform for providing me with valuable connections.

-

Reportedly, the largest share of component localization among drone producers in Ukraine is currently at 70%.

-

First Contact, the well-known Ukrainian FPV drone manufacturer whose drones were used in the famous Operation Spiderweb, which destroyed a third of the Russian strategic bomber fleet, told Ukraine’s Arms Monitor that it has almost achieved 70% localization of FPV production.

-

In November 2024, Ukrainian FPV manufacturer Vyriy Drone presented the first fully localized FPV drone. “Some components have been quickly localized — for example, frames and propellers, i.e., parts that don’t involve electronics. As for electronics, Ukrainian manufacturers are also capable of supplying the market with stacks and ELRS systems, but this potential is currently hindered by the VAT taxation system,” Vyriy Drone, told Aeronaut.

-

Full localization in Ukraine increases the production cost of drones by Vyriy by around 70 USD, so this model was not yet planned for mass production. Vyriy’s mass-produced model, which offers a competitive price, consists of 65–70% Ukrainian components.

-

In March 2025, Vyriy Drone delivered a batch of 1,000 locally assembled 8-inch thermal imaging FPV drones made entirely from Ukrainian components.

-

According to Ukrainian journalist Bohdan Miroshnychenko, the company produces some components in-house, while others come from Ukrainian contractors. Vyriy Drone has independently localized the production of frames, initiation boards, flight controllers, and radio control systems. At the same time, video transmitters are manufactured by the Ukrainian company DEC-1, engines by Realgold LLC, Motor-G, Enei, and UAV Technology, and cameras by Odd Systems.

“The basic electronics are imported, so in a purist sense, it’s not a 100% Ukrainian-made drone. However, this isn’t critical, as basic components are easy to source on the market, while setting up their production in Ukraine would be difficult and perhaps not particularly practical,” he added.

Component Dependency on China

China is currently the main supplier of components for drones and unmanned aviation in general. While Ukraine has managed to find substitutes or localize production in some areas, it remains dependent on China in others.

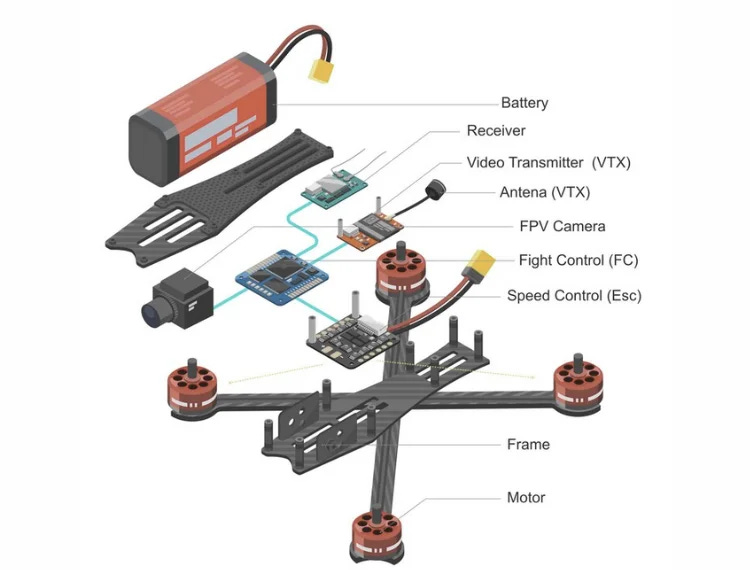

“Ukraine’s dependency on China remains significant, especially for motors, controllers, programmable chips, and cameras, including affordable night-vision devices. Ukraine has successfully established production of frames, propellers, and batteries,” said Valeriy Borovyk, founder of the First Contact company, in an exclusive comment to Ukraine’s Arms Monitor.

Much worse is the situation with Ukrainian small enterprises. A representative from the Ukrainian drone manufacturing startup, SkyForce, commented that the company depends on China for about 95% of its components. “A similar situation exists for most relatively small-scale manufacturers — all are heavily reliant on Chinese parts. The only items we don’t purchase from China are the printed circuit boards, as we work with a Ukrainian manufacturer, and antennas, which we also source domestically — these are actually better than their Chinese counterparts. We are also currently working with locally produced aluminum frames, which are of good quality. Everything else, however, comes from China. At the moment, there are no issues with purchasing and delivering components from there,” he added.

Among the biggest dependencies, SkyForce highlighted cameras — especially thermal cameras, which are in high demand by the military. The second is video transmitters, which relay the image from the camera to the pilot; these are complex components. “While I’ve heard of Ukrainian manufacturers attempting to produce them, as far as I know, there are no competitive options in terms of quality and price,” they noted. The third key dependency is flight controllers, according to SkyForce.

Electronics

-

As of December 2024, five Ukrainian companies were able to produce electronic components of the required size and purpose – Militarnyi reported.

-

They used Chinese microchips and other simple elements like transistors as semi-finished products. According to manufacturers, there was no need to get rid of Chinese components in this niche because these parts are widespread in civilian use and are of sufficient quality, making their sale impossible to ban.

-

In December 2023, Ukraine’s Ministry of Digital Transformation presented a strategy for digital innovation development. One of its key points was the construction of a chip manufacturing plant by 2030. On January 14, 2025, the government approved this strategy.

-

Minister Fedorov stated that the factory would be able to produce up to 50,000 chips per month.

-

Currently, Ukraine urgently needs a plant that would produce 110–180 nm chips. Specifically, chips manufactured using this technology are optimal for military and industrial electronics, as well as aerospace applications. Building a plant for 110–180 nm chip production is significantly simpler and more cost-effective.

-

Ukrainian developer of thermal vision cameras Oko Camera estimated the cost of building such a factory at $1 billion: “One billion is just the start. Five billion seems more realistic”.

The Ministry of Digital Transformation noted that, according to their preliminary estimates, the total amount may range from $1 to $3 billion.

-

Building an average semiconductor manufacturing plant typically takes 2–3 years in peacetime. However, given the situation in Ukraine, the timeline may be adjusted.

-

“Whoever controls microelectronics can win the war,” summarized the CTO of Oko Camera for DOU.UA.

Motors

-

“Today, the dependency on China in motors is almost absolute,” said the Ukrainian manufacturer AeroMotors in a commentary to Ukraine’s Arms Monitor.

-

The vast majority of motors for FPV drones are supplied from China. This applies to both complete motors and key components. Ukrainian manufacturers either assemble motors from Chinese parts or import them fully assembled. China has well-established production lines, mass production capabilities, and pricing that are difficult to compete with without significant investment in Ukraine.

-

The Ukrainian manufacturer and pioneer in the field of motor production, Motor-G’s production is approaching 100,000 motors a month, mostly for FPV drones, reports Kyiv Independent. This means they can equip 25,000 FPV drones per month.

-

“These motors are designed and manufactured in Ukraine. The local content is about 70%, with the rest imported. The main Chinese component remains the neodymium magnets, over which China holds a global monopoly. However, this is not critical since these magnets are widely used in civilian industries,” the company CEO told Militarnyi back in December 2024.

-

According to AeroMotors, Ukraine’s potential in this sector is very high: “We have engineers, a manufacturing base, and geologically confirmed deposits of rare-earth elements, including neodymium—a key component for producing magnets. These resources are not yet being developed, and starting extraction and building a magnet production plant will take years, but it is a strategic direction worth initiating now”.

-

In Ukraine, FPV motor production is only beginning to develop, so its market share is currently non-competitive. To understand the scale of demand: in 2024, approximately 2.2 million FPV drones were produced in Ukraine (according to open sources), creating a demand for roughly 8.8 million motors per year—that is, over 730,000 motors per month.

-

If production reaches 10 million drones per year, the demand would rise to more than 3.3 million motors per month. Currently, almost this entire demand is met by Chinese suppliers.

Scaling up local production requires funding to purchase and install machinery—this is a key condition for achieving mass production and competitive quality.

-

In the United States, a magnet production plant will soon be completed, and the Ukrainian company has already been in contact with them. The Americans work only with large orders (around 500 tons) and at a higher price, but the main advantage is independence from China.

-

In Ukraine, AeroMotors is already launching domestic motor production to capture a significant share of the local market and expand into Europe. Interest in partnerships has already been confirmed by companies from Denmark, the UK, and France, all of which are also looking to reduce dependence on Chinese suppliers.

Cameras

-

Ukraine has several manufacturers of thermal imaging modules, such as SeekUAV, Odd Systems, and Oko Camera.

-

Oko Camera is a Ukrainian company founded in 2022 that designs and manufactures thermal imaging cameras for unmanned systems. In a commentary to Ukraine’s Arms Monitor, the team of Oko Camera shared that at present, according to their estimates, the production of FPV drones in Ukraine depends on the import of thermal imaging cameras from China for approximately 90% or more (possibly even up to 95%). In fact, there is very little data available, and it is difficult to measure accurately.

For FPV drones, the most critical factor has been and remains the price. There is currently no country or supplier in the world that can offer components of the same quality at a lower or even comparable price than China.

-

“We have conducted an in-depth study on the localization of thermal imaging camera components and can state with certainty that it is impossible to produce a competitive product without Chinese components—particularly the sensor and optics—of the same quality and at the same price as those from China. Competing with China on price is simply not possible,” said Oko Camera.

There are several reasons for this, including state support from the PRC and a targeted development program—the so-called Optics Valley—which has been operating for decades, as well as other factors. Notably, China controls over 80% of the world’s germanium production. As a result, there are two different prices for germanium in the world: the global price and the Chinese price, and the difference between them is significant.

-

In the context of thermal imagers for drones, Ukraine currently does not manufacture its critical components, particularly sensors. In fact, globally, thermal imaging sensors (arrays) are produced by only a few countries.

Frames

-

Frames, along with propellers, are considered among the ‘simplest components,’ and Ukraine has successfully localized their production.

-

Their production is straightforward and was carried out at one of the many Ukrainian plastic goods manufacturers using injection molding machines—automated equipment that shapes plastics into specific forms.

“The process is not complicated, as it involves a very simple two-component mold. There are some specific requirements, though, since the propeller’s shape must be precise and perfectly centered. Currently, there are more than a dozen, if not several dozen, such manufacturers in Ukraine,” Oleksiy Babenko, the founder of Vyriy Drone, told Militarnyi.

-

The cost of carbon frames in Ukraine turns out to be even lower than in China, allowing local producers to compete with foreign manufacturers.

-

The Chinese use a complex system for cutting carbon frames and do not economize on carbon. They design the frame separately and then arrange the parts on the carbon sheet without concern for compactness.

-

The Ukrainian project, from the start, aimed to minimize waste, so engineers planned the layout on the carbon sheet in such a way that only minimal gaps for the milling cutter remained between parts.

-

Carbon is not produced in Ukraine, so the raw material problem still exists. There is no healthy competition in this sector on the global market—if carbon is produced in other countries, its quality is lower and its price higher than in China.

Defective Chinese Components

Multiple sources prove that Chinese components often have defects and unnecessary elements, while Ukrainian components are optimized for the specific needs of the Armed Forces.

-

Fiber-optic cable: Defects are often found in spools of fiber-optic cable from China, causing the cable to break during a drone’s flight. Detecting these defects before shipment is impossible—the spools look fine and measurements are normal. However, small bends hidden inside the winding can cause the cable to snap mid-flight, preventing the drone from reaching its target.

“That’s why we have recalled all batches with Chinese spools and are replacing them with ones we produce ourselves,” the CEO of Ukrainian company 3DTech told Ukrinform. 3DTech, which has five approved by MoD models of its fiber-optic drone series, Predator REBOFF, produces its own spools in-house, achieving near-complete localization of its production cycle, excluding the raw materials, as the company, like others, still relies on imported fiber-optic cables from China.

Fiber-optic cable is not produced in Ukraine, and attempts to secure supplies from several other countries have failed. With about 80% of global fiber-optic production coming from China, there is virtually no alternative.

-

Motors: The motor manufacturer said that when ordering components from China or other countries, it’s not possible to thoroughly control every stage of manufacturing. This is critical, as even the slightest deviation can affect the engine’s performance.

Ukrainian team uses advanced aluminum processing methods to manufacture rotors: “By developing a new type of rotor that speeds up motor production, we have reduced defects and made the motors more resistant to impacts.”

Localization Challenges

-

Ukrainian legislation exempts imports of drone components from VAT and customs duties. However, Ukrainian manufacturers of components become uncompetitive because they still have to pay those fees. The next logical step for the government would be to extend VAT exemptions to local companies producing components in Ukraine.

-

The production of some key technical components in Ukraine is currently very challenging, if not impossible, due to complexity and huge investment needs, so the focus is on quality final assembly and developing proprietary software to better realize system potential and meet military needs.

-

“The manufacturer is also looking ahead — tomorrow the war will end, and then there will be no state orders. For instance, investing in chip production is unlikely to happen unless the war lasts for a long time or there are guaranteed consumers outside the country,” explained the founder of First Contact to Ukraine’s Arms Monitor.

Component Library

In April 2025, Ukraine launched the “Component Library” initiative, which will now operate under the Ministry of Defence of Ukraine. This is a secure digital platform where Ukrainian companies producing finished products—such as UAVs, MLRS, and EW/ESM systems—can easily find component manufacturers, establish partnerships, and thus reduce dependence on imports and expand local production.

Currently, the Library has nearly 180 registered users and features over 130 product listings.

“All initiatives that support the localization of production and help Ukrainian manufacturers cooperate more closely and unite are very important and beneficial,” commented Oko Camera.

To be fair, Russia also depends heavily on continued Chinese support not only for FPV drone production, but also for Shahed/Geran drones and other military capabilities. As The Insider has found, Russia depends on Chinese electric motors for drones. There is no known Russian production of drone motors at a comparable scale. Russia imports over $100 million worth of drone motors annually.

If Russia were to drop out of the production process for a year to a year and a half—and it is unlikely it could establish domestic production of electric motors at this scale any faster—this would have an immediate and significant impact on the situation at the front, where drones have become a key type of weapon.

I would like to conclude with a quote from the founder of First Contact, who wisely noted that the world is moving away from globalization toward local alliances with their own production.

So far, it appears that the Russia–China alliance holds the upper hand, given their abundant natural resources and deepening military cooperation. In contrast, the Western alliance remains unprepared and relatively weak in the face of potential conflict.

It is entirely understandable that we do not have the full picture of their preparations and considerations, but through this material, I aim to highlight the seriousness of the issue—the significant asymmetry between the militarization of autocratic states and the Western bloc—and hope that stakeholders draw the right conclusions.