At the recent Russia-China Energy Business Forum, Rosneft’s Igor Sechin pointed out a notable prospect: by 2030, China might take up to 1.4 million extra barrels daily. Meanwhile, India’s need could climb higher, reaching 2.5 million more each day during that time. Together, their rising consumption adds up close to 4 million bpd. That matches about what Russia exported in crude at the start of 2025.

For Moscow, gaining just a portion of this expansion could make up for the 2.2–2.4 million barrels per day once shipped to Europe before 2022, marking a major shift in where its energy flows go. Talks are progressing, according to Russian Deputy PM Alexander Novak, aiming to continue routing oil to China via Kazakhstan beyond ten years; however, exact amounts and dates haven’t been set yet.

Still, goals face tough facts. Though the Eastern Siberia–Pacific Ocean line runs full, boosting Russia’s share in China means big spending on fresh facilities. According to expert Stanislav Mitrakhovich, sea shipments work – but bring added challenges. To bypass Western penalties, Chinese importers use middlemen and layered firms; this approach has already worked when buying Iranian oil relabeled as coming from Malaysia.

Beyond China and India, new opportunities appear in Southeast Asia. Because of Vietnam’s growing economy, rising energy needs spread further. Indonesia has many people, and government support for cheap fuel boosts consumption. Meanwhile, more tourists visit the Philippines, increasing local demand. Together, these shifts may drive regional oil use toward 6.4 million barrels daily by 2035 within ASEAN.

This move toward the East isn’t just about business – rather, it signals a deeper change in how influence is balanced worldwide, bringing serious consequences.

Russia’s shift toward Asia goes beyond simple variety – it marks a major change in world energy routes since Cold War times. Instead of selling to Europe, Moscow now turns east, showing Western penalties hurt but don’t break its economy. To keep buyers and stay independent, Russia sells oil at a lower rate – now about $4–$7 less per barrel, down from an $8 drop in 2022.

This change reduces Europe’s power in energy talks with Russia, whereas it increases Asia’s reliance on Russian resources. Such moves use economics as a tool, where sanctions encourage partnerships instead of separation.

Beijing’s growing oil purchases from Russia bring potential gains – yet also challenges. While lower-priced crude helps fuel China’s industrial growth while cutting expenses for factories, relying more on Russian supplies could backfire should relations with Moscow weaken or Western sanctions tighten around Chinese firms.

China needs affordable energy while also spreading out its suppliers. Due to heavy imports from Russia, refineries now ask – how reliant is too reliant? That’s why nations such as Saudi Arabia, Brazil, or Guyana still matter, even if Russian oil costs less.

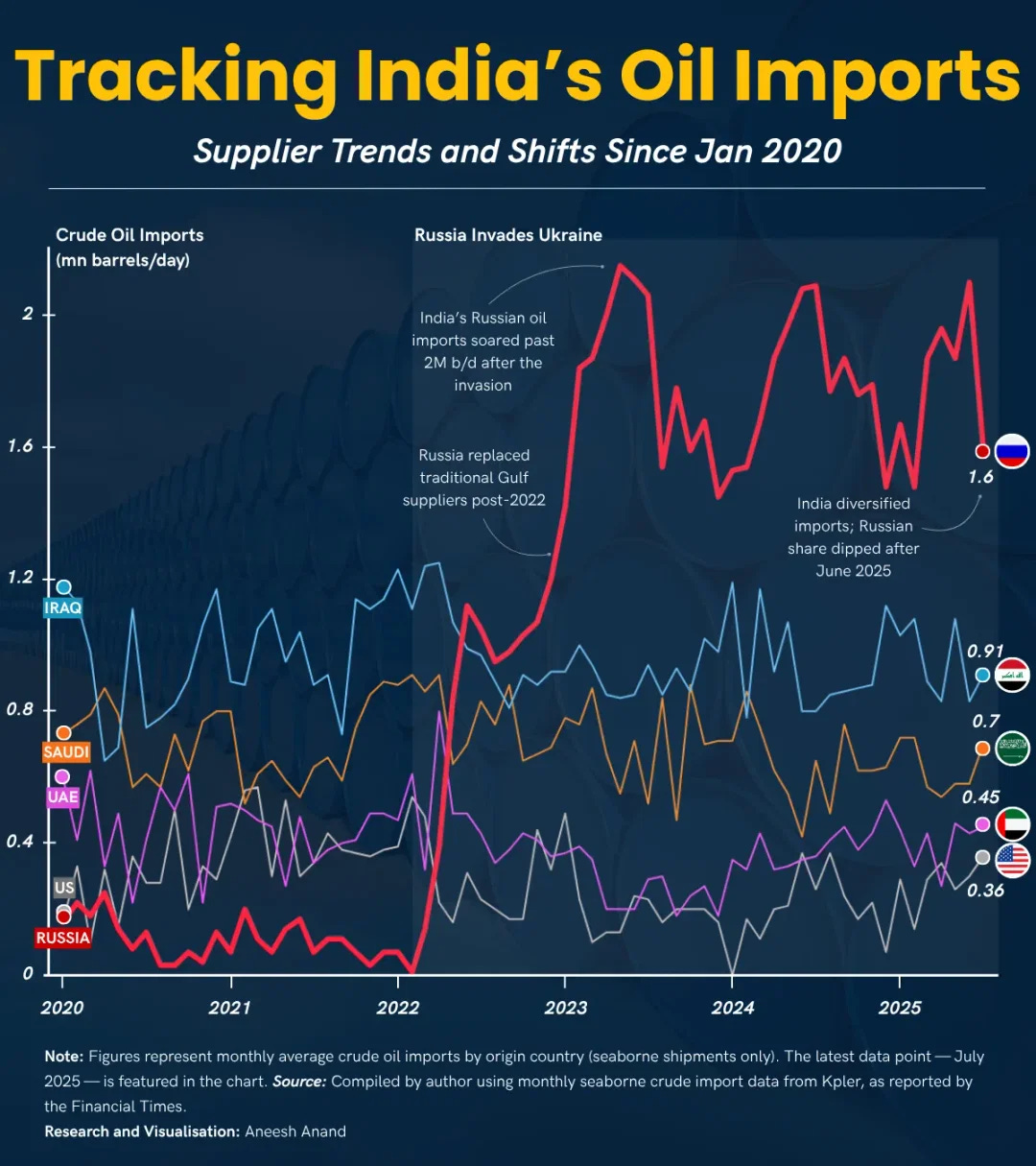

India stands out on the global stage due to its unique stance. Since 2022, New Delhi has boosted oil purchases from Russia significantly; at the same time, it keeps solid relations with Western nations. Rising need for diesel – fueled by building projects and freight transport – has turned India into the world’s quickest-growing large oil buyer, allowing more bargaining power across different providers.

India’s readiness to buy Russian oil gives Moscow key income, whereas New Delhi benefits from cheaper fuel for growth plans. Still, similar to China, India faces questions about relying too much on one source – especially if Western nations influence its decisions down the line.

Maybe the biggest overlooked factor is that Russia belongs to OPEC+. Though output rose by 2.88 million bpd in 2025, future cuts could still happen before 2030. Gaining access to rising Asian demand might depend less on infrastructure or output limits – and more on following group rules.

This sets up a core conflict: Russia’s push to grow its share in Asia clashes with OPEC+’s goal of managing prices by limiting output. Should demand in Asia rise as expected, unity within OPEC+ could weaken – pushing Russia toward a choice between staying loyal or seizing new markets.

Russia’s way of dealing with sanctions – the so-called shadow fleet of oil tankers avoiding Western monitoring – marks a shift in how global trade functions. This alternative system, built on layered company networks and legal loopholes across countries, shows that persistent governments can bypass economic restrictions.

The effects go further than just power supply. When Russia keeps exporting major amounts of oil even under wide-ranging Western penalties, this sets an example others might follow – thereby weakening trust in economic pressure as a strategy abroad.

The race for Asia’s oil market shapes how global influence might shift. Should Russia join Asian energy networks, it would rely less on the West while growing closer to China and India. Cheaper Russian oil helps Asian industries move faster and build stronger.

At the same time, classic Middle East exporters face sharper competition, which could weaken OPEC+ unity. Producers in Latin America – Brazil, for example – gain unforeseen openings, altering regional balances.

The key issue isn’t if Russia can meet Asia’s rising demand – routes and transport setups are workable. It’s whether political intent aligns across nations for such a shift, also what sort of global landscape follows from reshaping energy flows.

At present, Russia’s oil moves steadily toward the East, slowly reshaping global power – one ship after another.

Based on reporting by Aleksandr Butov for World Oil and Gas Industry News

Join the Conversation:

📌 Subscribe to Think BRICS for weekly geopolitical video analysis beyond Western narratives